La TVA dans les Parcs de Loisirs

18/10/2018

Do you need a master’s degree or an army of accountants and tax experts to calculate VAT to be reported?

Reduced rate, standard rate, mixed rate?

VAT on a global entry price or a rate for each attraction?

Drinks and snacks sold on-site or to take away, packaged or not?

Entertainment and shows?

A bundled price combining several of these elements?

Do you need a master’s degree or hire an army of accountants or tax experts to calculate VAT to be reported?

Yes, it seems that amusement parks are at the intersection of several complexity factors. Just reading the Official Bulletin of Public Finances & Taxes (BOI) can be overwhelming!

Let’s try to clarify or rather illustrate:

By default, except for exceptions specified in the texts, the applicable rate on entries and activities is 20%.

Indoor Playgrounds: Access to the maze is at 10%; if other activities such as a trampoline are offered that are not in the main maze, then a proportionate part of the entrance ticket will be at 20%. However, if the trampoline is within the maze, it is considered an apparatus and therefore subject to 10%.

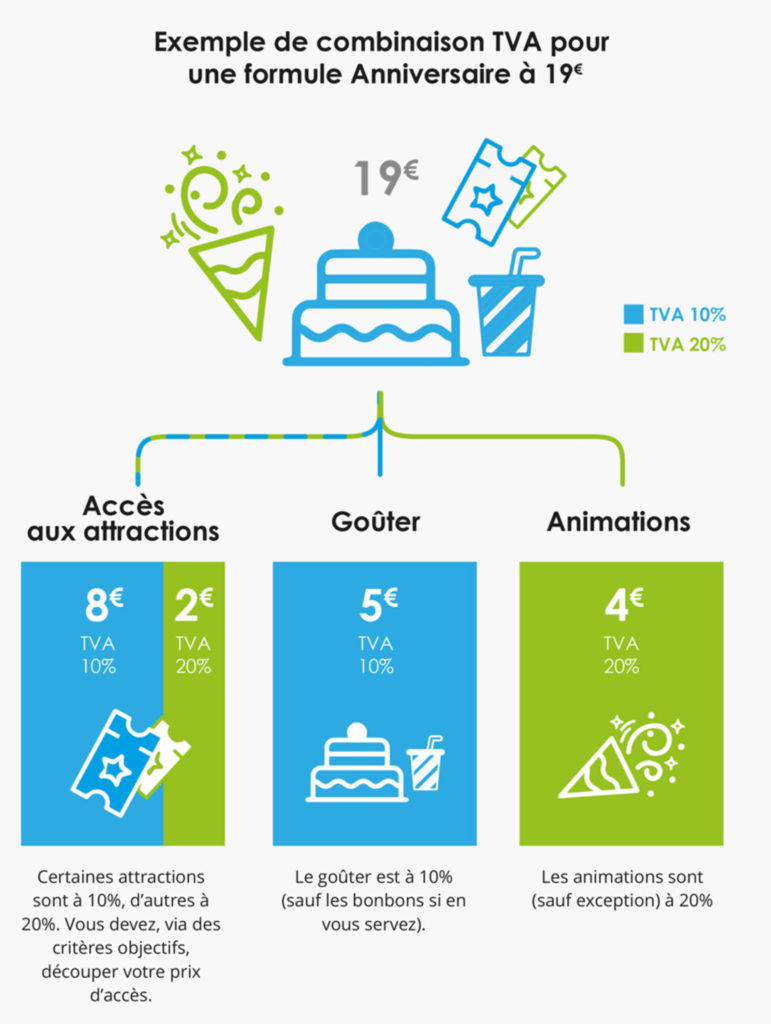

A mixed rate applies if a single price allows access to attractions with different rates. Objective criteria such as investment amount, floor area, capacity, etc., need to be documented for this allocation calculation. This information may be requested during an audit.

High Ropes Courses: Access to high ropes courses is subject to 10% VAT according to article 210 of the BOI. If other activities such as paintball are combined in a package, an allocation is necessary.

Trampoline Parks: Considered as sports activities, article 320 of the BOI currently indicates a 20% rate for trampoline access. This is generally the case for all sports and leisure activities unless exceptions apply.

Escape Games: Unambiguously, article 345 of the BOI assigns a 20% rate.

Virtual Reality: Not yet specified in the texts. In this case, it is advisable to apply a 20% rate as a precaution.

If clarifications are provided later by the tax administration (note: clarifications, not changes to the law) and the rates change favorably from 20% to 10%, retroactivity is possible. A well-argued claim to your local tax office (SIE) may be worth considering.

Snack Sales: 10% or 5.5% for canned beverages?

According to article 390 of the BOI, except for confectionery and alcoholic beverages at 20%, everything is sold at 10% because it is considered on-site sales (restaurant-type service).

However, there seems to be some ambiguity. In a document concerning reduced rates in the restaurant industry, the tax administration suggests that regardless of the location or type of sale (on-site or takeaway), everything in cans, bottles, sealed bags, etc., should be subject to 5.5% because they “allow preservation” … but caution is advised!

And what about chocolate? It’s good, yes, but it’s complicated! To simplify, if your supplier (Metro, Confectioner) invoices you at 20%, also apply 20% when selling. If you purchase at 5.5%, resell with 10% (unless you eat the whole chocolate bar before reading this).

And what if you offer packages?

For a children’s birthday package with entry, snacks, and entertainment at a bundled price, your VAT should be calculated for each component.

With Qweekle, you have all this flexibility automated from your point of sale to your accounting journal. Is it complicated? Not so much with QWEEKLE!

Note that your associations or professional syndicates (SPACE, SLA, SNELAC, etc.) can provide excellent support in case of difficulties or questions and can offer even more precise insights for your specific activity.

References:

BOI – VAT – Reduced rates – Admission fees in parks…

Service-Public.fr Practical Sheet – Reduced VAT rate in the restaurant industry

BOI – VAT food